Investment Philosophy

At BOCHK Asset Management, we endeavour to maximise your potential returns by implementing active risk management and formulating disciplined portfolios.

By focusing on the quality and value of investment, we seek to deliver consistent investment returns through a unique combination of fundamental research and quantitative analysis.

Recognising principal protection is as important as wealth accumulation, we adopt a prudent approach at times of market fluctuation.

Investment Process

Our institutional quality investment process is based on fundamental research supported by quantitative analysis.

Equity

While employing our proprietary tools and research, we seek advice from external brokers and research providers. We also enjoy a unique edge in sharing the resources in researches and strategic analysis from the BOCHK Group, which provide us with valuable insights into China's economic policies and issues.

Our stock selection process is based on fundamental research. We visit the company management, carry out in-depth analysis and conduct due diligence on each company that we cover. Our fundamental research and portfolio formulation are supplemented by stringent quantitative analysis.

Fixed Income

"Value for risk" is our philosophy for fixed income investment. We understand that clients have different risk appetites and return requirements. Thus, by assessing "value" and "risk" from the perspectives of clients, we invest in bonds with adequate yields to compensate the risks borne by clients.

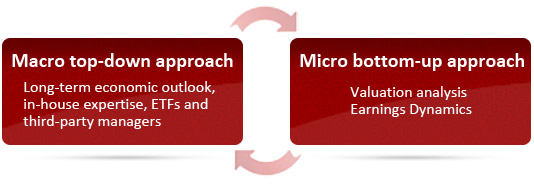

We believe that a disciplined fixed income investment process is indispensable for superior and consistent investment performance. We carefully evaluate both "value" and "risk" in a comprehensive and systematic way before making investment judgements. Our top-down and bottom-up investment approaches are supported by in-depth fundamental analysis and proprietary quantitative models.

|